Believe it or not, about 70% of businesses fail within the first two years of their operations. A large reason for this is a lack of proper business management. And since finances are the basis of any business, this isn’t surprising.

If you’re someone with an entrepreneurial spirit, you’re well aware of the benefits of starting a company—and the possibility of failure. You need to have a financial plan to weigh both of these things.

Are you looking to better manage your business finances? If so, read on and learn how to do all of this!

Keep Track of Your Expenses

You should keep track of your expenses for two reasons: to stay mindful of how much money you’re spending and to ensure you’re not spending more money than you have. When you keep track of your expenses, you can budget more effectively and make adjustments to ensure you’re living within your means.

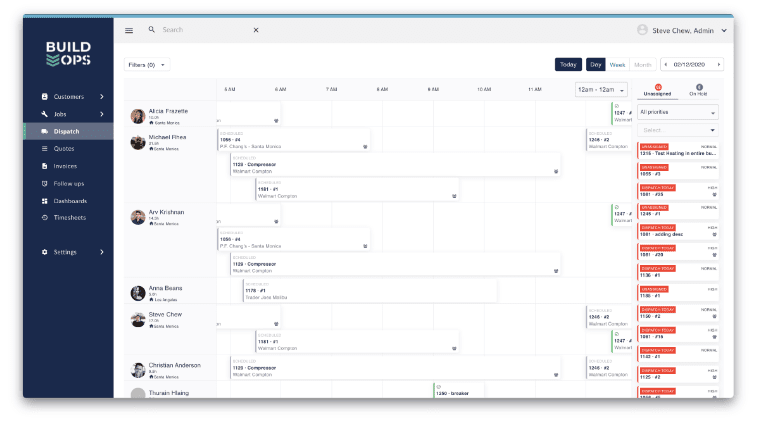

There are a number of ways to track your expenses, including using the spend management software, a budgeting app, maintaining a physical budget, or tracking your expenses manually. No matter which method you choose, keeping track of your expenses is crucial to financial success using Zintego.com

You can also read: Benefits of Using HR Software

Make a Budget and Stick To It

Budgeting is a key component of effective financial management for any business. A business budget provides a roadmap for your company finances and helps you track income and expenses so you can make informed decisions about where to allocate your resources. Stick to your budget as closely as possible to ensure that your business is on track to meet its financial goals.

Review your budget regularly and make adjustments as needed to ensure that it remains realistic and achievable. Creating and sticking to a budget can be difficult, but it is worth it in the long run.

Know Your Financial Goals

As a business owner, it is crucial that you know your financial goals. This will ensure that you are making the best decisions for your company’s financial future. Some financial tips to consider when setting your goals include: How much revenue do you want to generate? What are your short-term and long-term expenses? And how much profit do you want to make?

By having a clear understanding of your financial goals, you can make sound decisions about how to allocate your resources.

You can also read: Types and Benefits of Affiliate Marketplaces

Take Control of Your Business Finances

If you want to be successful in business, it is essential to have a handle on your finances. By following the tips in this article, you can get a better understanding of your financial situation and make informed decisions about where to allocate your resources.

Keep track of your income and expenses, create a budget, and stick to it. Have a clear understanding of your business goals and what it will take to achieve them. Build a strong financial foundation for your business finances, and you will be on your way to success.

If you enjoyed this article and would like to read more just like it, visit our website daily.