Year on year, the world becomes more focused on digital in our day-to-day life without really thinking about the flow-on to traditional aspects of life, including our wills and legacies.

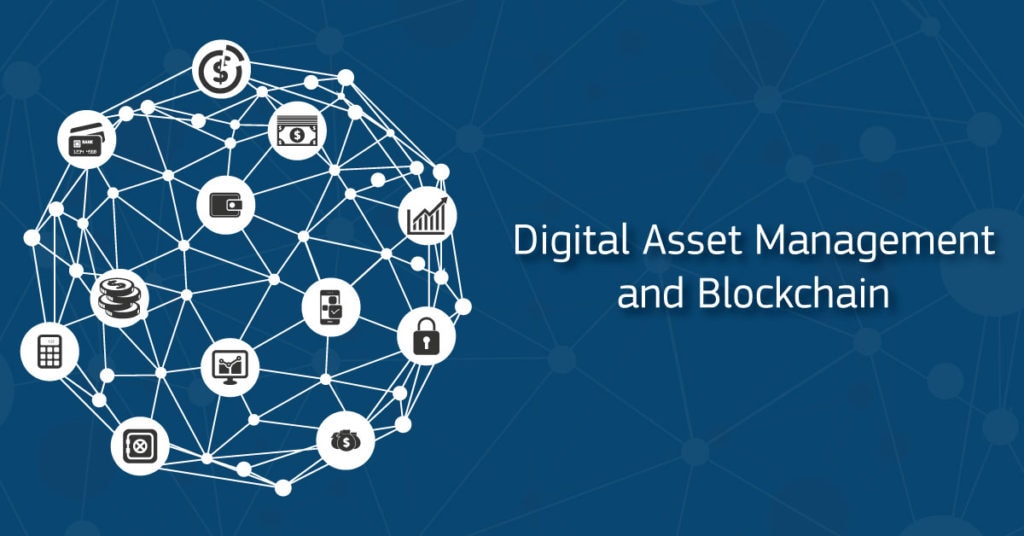

One important area that ties to this is digital assets and ensuring these are appropriately managed in a will. Especially if you have sensitive digital data that needs to be maintained privately or hold digital items of a high value.

Russel Morgan writes for Forbes, “Many aspects of our lives that once required the physical exchange of documents or money have now been digitized and exist in an intangible form online.”

What Do You Need To Think About With Digital Assets?

At this point, there is a range of different digital assets to consider. Some main types to consider are:

Digital Property

This includes more common 21st-century assets like cryptocurrencies that need to be legally administered through an estate. The difference here to traditional property transfer is log-ins. And other credentials will need to be provided to enable access.

There might also be unique requirements from the associated organization or body that hold the digital property.

You may also like: Six Reasons to Use Online B2B Marketplaces

Digital Records

These are files that don’t necessarily have an inherent value yet are important to loved ones and the deceased such as digital documents, photographs, and recordings.

They won’t be passed on to family or beneficiaries under a will or intestacy; however, planning for transfer may be required if the records are stored in the cloud or on personal devices such as computers or hard drives.

Digital Accounts

Like digital records, these don’t have a specific value; however, they can hold personal information associated with correspondence and impact an individual’s digital legacy.

In some cases, digital accounts hold purchased assets that legally can’t be transferred upon the owner’s death based on copyright laws. It’s important in this instance to understand the guidelines and usage rights for each account. Then take the necessary precautions to enable access or even transfer as part of estate planning and real estate seo.

Where To From Here For Digital Asset & Estate Planning?

Estate planning is a high-level undertaking no matter where you’re at in life. To bring more clarity and understanding to the process of parsing digital assets, consider digital asset custody solutions.

For more information about this timely topic, this graphic from I Will Solicitors outlines key points to start organizing these intangible assets. From essential statistics to a 101 on the different types of digital assets.

You can start taking important steps like creating an inventory and updating account access details. And discussing your intentions with your executor and associated beneficiaries.

Would you like to read more about Digital Assets-related articles? If so, we invite you to take a look at our other tech topics before you leave!