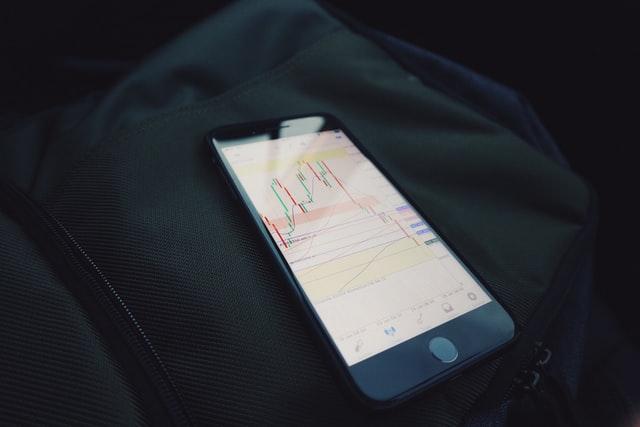

Until recently, trading in the money markets was a preserve of finance professionals with deep pockets and dependable networks. Today, technology is bringing down all the barriers and giving everyone access to the money markets. Fintech mobile apps are at the forefront of this revolution. These online trading apps provide access to all traded financial instruments with the help of brokers. However, these apps differ in function. This difference can make or break your trades. As a result, professional traders use specific apps to analyze the markets, execute their trades and exit the markets.

Qualities of a Good Forex (FX) Trading App

Every trading app is functionally unique, depending on its intended purpose. Some apps serve active traders best, while others fulfill the needs of passive traders more effectively. However, most traders use these apps with an online forex resource like EarnForex to improve their odds of winning more trades. Despite the difference in performance, every good trading app must have three essential qualities. These are:

1. Trading Education Materials

In trading, knowledge is king, and adaptability is queen because the market is constantly changing. Most trading apps provide the latest technical and fundamental learning materials about the market to fulfill a trader’s need for information. This information allows a trader to anticipate currency movements and open trades with higher chances of becoming profitable over time.

2. Real-time Trading Information Updates

Typically, a currency’s price or value changes by the second. You will need precise updates of this information to make accurate trading decisions. Most mobile trading apps lag, and in extreme cases, crash during live trades because of the limited processing power of mobile phones. Therefore, you need to run several tests on your preferred forex trading platform to ascertain its reliability in streaming and trade speed.

3. Low Cost of Opening and Holding a Trade

In Forex, the cost of opening and holding a trade is called the spread or commission. Brokers calculate the spread by subtracting the asking price from the bid price. This difference is the broker’s commission for executing your trade.

Ordinarily, the spread is a small percentage of the unit currency that you are trading. However, this amount increases significantly for active traders, such as intraday traders and scalpers, to eat away a significant portion of their profits. Search the internet for an affordable broker to maximize profit. Now that you know what makes a good trading app, here are five apps suitable for trading experts you can use.

1. MetaTrader 5 (MT5)

The initial purpose of MetaTrader was to provide a trading platform for professional forex traders. Later, MT5 introduced other asset classes to the platform.

This platform has advanced features enabling complex technical analysis and real-time trading that may be hard for beginners. On the other hand, expert traders will find MT5’s elaborate collection of trading tools more valuable than those of average trading apps in today’s market. Additionally, traders can open eight orders in different markets simultaneously and even allow other traders to copy their trades through MT5’s copy trading option and algorithmic trading tool with online trading apps

The MetaTrader 5 is available on Android smartphones and iPhones.

2. NetDania Stock and Forex Trader

Like MT5, this is available for use by smartphone and iPhone users. NetDania trading platform trumps other apps because of its versatility and super easy user interface. It offers real-time interbank rates for forex and entry to the latest price quotes on commodities, stocks, and over 20,000 other financial instruments.

This app also streams live charts and up-to-date market news from reputable financial news sources. It has a news filter system that allows you to tailor the user menu to meet your price quote and news preference. In case you are multitasking, the app will enable you to set trendline or price alerts on given commodities, stocks, or currency pairs.

3. eToro

eToro serves both experienced and beginner traders with equal efficiency. For over one and a half-decade, eToro has continuously improved its services to command respect from traders. You can find this app on App Store and Google Play. It has a straightforward interface that is easy to navigate. You can also move quickly between devices using the eToro trading app.

You might also like A Guide to CRM Retargeting with Google Analytics (CRM Software)

The eToro app comes with a free virtual portfolio with a demo account worth $100,000. You can use this account to familiarize yourself with the system. The app also has a one-click feature, analytics, and research featuring ProCharts, CopyTrader, and its internal networking platform. Moreover, the app has numerous financial instruments traded on the platform, including some popular cryptocurrencies. Each crypto trader can receive customized alerts for online tokens like Bitcoin on their watchlist and get crucial market data by the second.

4. Trade Interceptor

Both Android and iOS users can access the money markets using Trade Interceptor. This app allows you to trade commodity futures, binary options, and currencies through your favorite broker. You can also access this platform’s technical analysis tools and market analysis. Each trader can access almost 100 technical indicators.

Apart from indicators, it gives you access to live updates of price charts and price quotes of all the financial instruments traded on the platform. You can set notifications for news releases and price levels for easier trading. Additionally, one can also access day-to-day economic news schedules and live market news. Most traders use this data for backtesting their trading strategies and simulating trades.

5. Thinkorswim Mobile

This app belongs to TD Ameritrade, which allows the broker’s clients to access several markets. It is easy to navigate, courtesy of its simple user interface. Traders on this platform have unlimited access to live charts that streams continuously. Additionally, users can create and load regular technical indicators that they have created for their personal use on the online trading apps

You can also access the latest financial market and business news and stream live news from CNBC. Traders with live orders can follow their trades and make necessary trade adjustments using the Thinkorswim mobile app. Additionally, all traders on the platform can deposit money using the app. Finally, you can test your trading strategies using the platform’s trade simulator.

Final Thoughts

Your time to trade like a pro is due, and you need to level up by using these top five apps available online for trading experts. Find one that suits your trader profile and test the waters using the platform’s demo account.

Would you like to read more about online trading app-related articles? If so, we invite you to take a look at our other tech topics before you leave!

![]()