With a population of over one billion, India is an outstanding resource for FinTech. However, until we advance, we first need to describe FinTech. FinTech relates to the emerging sector that allows the use of new technologies to process financial transactions. These businesses provide finance programs, including handling pensions, employment compensation, and automated payments. The FinTech sector has expanded significantly and is projected to expand much larger in the future.

India has a major role in this global pattern. India’s FinTech sector has seen over half a billion dollars invested in 2010 alone, and the market has shown potential for continued expansion. This form of technology has substituted paper-based transactions in various fields, including electronic transfers, wealth banking, financing, and fundraising. The exponential development in financial technologies has contributed to gains for consumers by enabling them to reach clients that were historically overlooked, reducing prices, and growing competitiveness in Java Application Development.

The financial industry is a mixture of banking and technology. Technology advances at an accelerated pace which is why fintech grows rapidly. Thus far, disruption claims have focused on improvements at the consumer engagement stage, i.e., software apps, digital user experience, etc. The year 2021 aims to be a substantially successful year for the financial technology market.

You may also like A Guide to Agile Scrum ITSM Methodology in Mobile App Development.

The future of Fintech business looks positive and rising steadily on the backbone of the growth of start-ups in the Fintech industry, diffusion of mobile phone users, a continuous build-up of the digital infrastructure, and overall streamline of financial operation in several industries. In the present recent survey, by Research and Markets, as of March 2020, India, besides China, represented the uppermost FinTech adoption rate of 87 percent, out of all the emerging markets in the world. However, on the other side, acceptance patterns across the world were somewhat different.

Through the transition of payment gateways, digital currencies, and online banking. FinTech would completely revolutionize the business by considering the consumer as a monarch and providing tailored benefits. Despite initial reluctance by larger banks to integrate technology in their structure, changing customer behavior has somewhat introduced this change to this industry, which any financial institution cannot overlook. The position of government regulators would be equally critical to maintain a robust FinTech infrastructure to encourage healthy competition in the industry.

We look at some of the new developments that will form the financial market over the next few years.

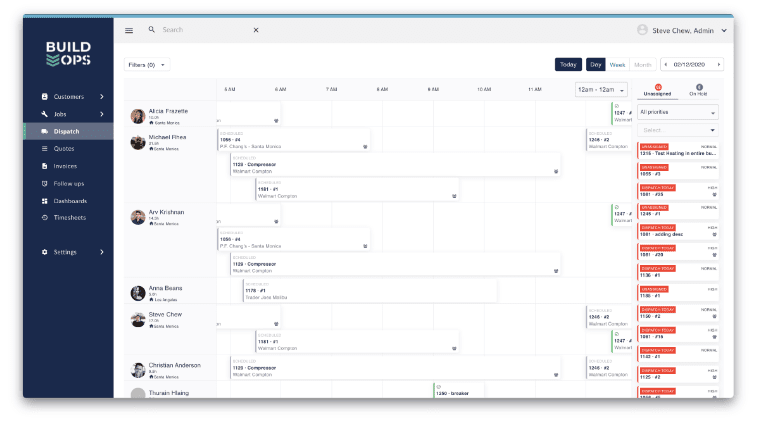

- Non-manual process automation (RPA) – The RPA software utilizes robotics and high-tech solutions to function that humans traditionally did. In 2021, more companies will implement RPA to perform various back-end activities, including compliance reviews, consumer on-boarding, account maintenance and closure, trial balancing, credit card, and mortgage handling. Thus, RPA helps fintech organizations handle repetitive jobs effectively, freeing up human capital for more critical activities in the workplace.

- Blockchain – Blockchain technology has made it possible for transaction documents to be more accessible than ever before. With blockchain technology, transactions have become much more reliable, and this has helped the customers trust the financial firms that have this technology. Blockchain would prove to be imperative to the modernization of banking in 2021. Java Application Development.

- AI and ML – Artificial Intelligence and Machine Learning (AI/ML) were unstoppable. Experts expect AI technologies can significantly minimize operating costs by a promising fintech company by 2030. Artificial Intelligence is often used to track and eradicate real-life financial frauds and risks. It will also boost consumer service. It can conveniently record all the experiences with the consumers and the company and call upon stored data to give only the best prices to customers. Commercial banks have become unable to adjust and have not adapted to satisfy consumer demands, and because of this, customers are gradually moving to fintech companies. Fintech firms can boost financial inclusion by delivering banking services to the poorer sections of society and also make banking fast, effective, and comfortable.

- Autonomous finance – Fintech is responsible for the development of autonomous finance. Online banking reshapes the way people connect with capital. These characteristics of financial innovations foreshadow the next generation of personal finance, including autonomous finance. Fundamentally, self-driving finance is focused on the concept of autonomously operating funds. Not just lets consumers make instant choices on their money in terms of when to spend it, how to accept the loan at best interest rates, or what to do about the overdrawn account, and the technology also executes all those tasks for you. Java Application Development.

- Biometrics for protection – This technology has made investing simpler, and people can now do something about their banking from smartphones. However, this has often produced many cybercriminals who are still searching for avenues around the scheme. This suggests that organizations would continue to rely on face recognition technologies to ensure safe and stable financial records. Biometrics, however is at a developmental point, with more and more contactless technologies being mainstream eventually. Furthermore, technological Java application development is happening at an unprecedented pace in our processes and the environment around us. These new developments will form the financial technology market in 2021, and it will get even closer to 21st-century consumers.

Would you like to read more about java application development-related articles? If so, we invite you to take a look at our other tech topics before you leave!

![]()