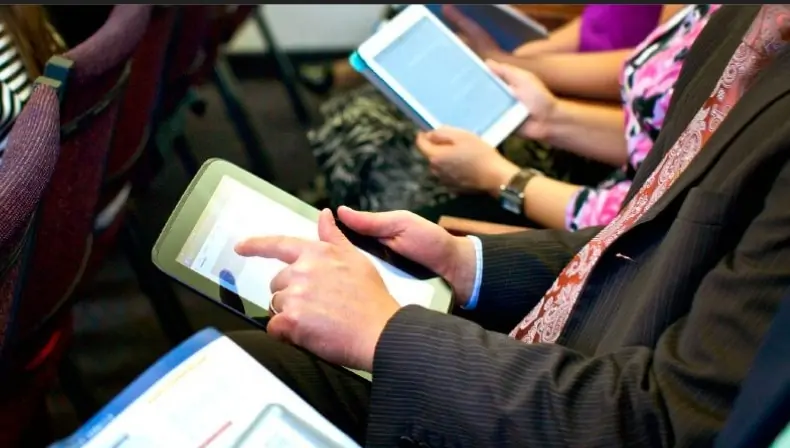

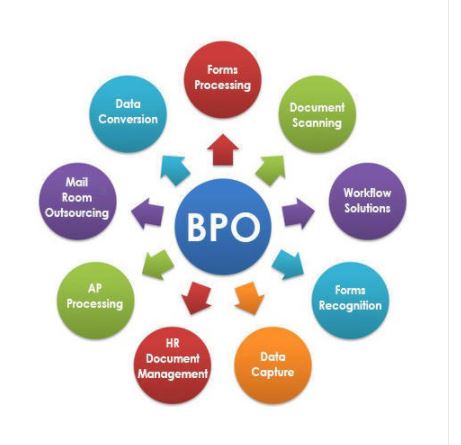

The insurance industry has undergone a lot of changes in the last two decades. Many such changes have transformed the way business is carried out in the industry. One such change is the growing reliance of insurance companies on insurance BPOs. By delegating all the non-core tasks to BPO companies, carriers have been able to focus more on core activities. The role played by insurance BPO providers in supporting carriers and agencies include:

Advancing claims settlement process

Insurance BPO providers can help insurers sort their claims management process. A delay in claims settlement leads to a bad customer experience. BPOs ensure there are no needless delays and go to the last mile to close matters as soon as possible. Furthermore, BPO services minimize the chances of errors with the help of advanced technologies. Also, they maintain the average TAT for each claim.

You may also like 5 Ways To Improve Online Business’s Productivity

Enhancing premium collections

Insurance BPO providers play an important role in premium collections. They understand customer needs with the help of analytics and use the insights to design customized solutions for customers. This helps in delivering something unique to every customer. In addition, enhancing the premium collection process allows insurers to clear the past due amounts.

Improving renewal processing

The service providers have a well-planned process to examine each policy at the renewal stage. The process banks on a checklist that includes checking the accuracy, determining changes in limitations/deductibles, renewal changes, and several other factors. Next, they communicate with customers about any further necessary changes. Finally, they record any alteration within the original and renewed premium and send it to insurers for further review.

Removing process challenges

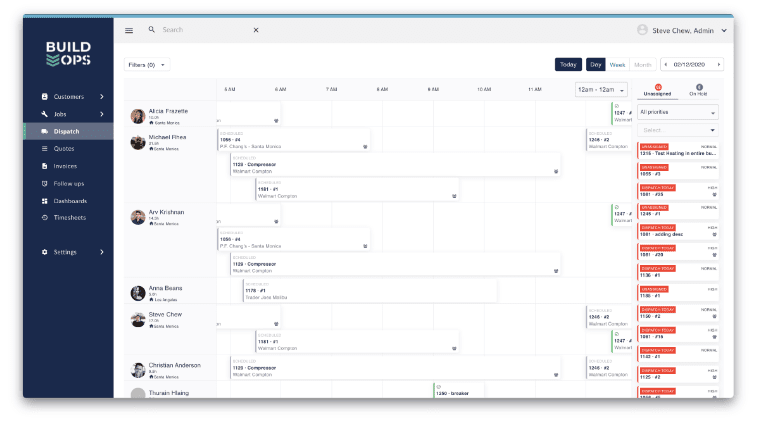

Insurance BPO providers play an essential role in changing the slow process of insurance submissions and extreme delays in rolling out quotes. These slow-moving processes raise a backlog for insurers. It results in an overburdened team, average service, and disappointed customers. Insurance BPO service providers use their expertise to grasp the operational pain points of insurers and use the industry’s best methods to improve operations. They bank on proper tools and technology to handle insurance processes thus helping you manage a sudden increases in workload very effectively. This boosts insurers’ operational efficiency, which ultimately widens their profit margins for BPO service providers.

You may also like 5 Proven Sales Management Strategies for 2022

Conclusion

With increasing complexities triggered by changing regulatory requirements, insurance carriers continue to face huge challenges in being on the right side of insurance compliance. Insurance BPOs ensure they are always in line with regulatory requirements by taking care of their non-core activities and allowing them to stay focussed on their core task of business growth.