Artificial Intelligence Vs Machine Learning: Artificial Intelligence (AI) and Machine Learning technologies are set to revolutionize an industry based on numbers and an industry still traditionally dependent on human expertise, analysis, and creative intelligence to progress and prosper. Some proponents of these processes believe that it will be a symbiotic relationship between man and machine. Others believe that their introduction will mean the demise of the human worker. So what are these concepts, and how will they impact the financial services?

AI vs. Machine Learning

Artificial Intelligence is a broad term, but was succinctly defined by Andrew Moore, Dean of the School of Computer Science at Carnegie Mellon University, as “the science and engineering of making computers behave in ways that, until recently, we thought required human intelligence.” A modern-day example of AI would be Apple’s beloved digital personal assistant Siri, who can assist in finding information, creating events, and providing directions purely based on voice recognition. Another example would be self-parking cars. Whereby the vehicle will park itself using spatial and proximity information without any human intervention.

Machine learning is a branch of AI that relies on analyzing data to improve itself through experience automatically. For example, Netflix has fully incorporated machine learning into its platform using predictive technology to make recommendations based on what the viewer has previously watched or rated. Music streaming providers such as Spotify or Pandora also use machine learning to recommend new artists based on what music users have listened to in the past. Recommendations continue to get refined and improved as the platforms continue to learn and analyze the users’ choices. Artificial Intelligence Vs Machine Learning

Implications to Financial Services

Based on how society has already embraced these powerful and useful technologies in other sectors. It was only a matter of time before infiltrated the finance industry. A study conducted in the UK identified that 86% of business leaders in the financial services sector said they were already using these technologies.

In addition, the World Economic Forum published a report earlier this year indicating that AI is fundamentally changing the physics of financial services. The bonds that have traditionally held together the constituent parts of financial institutions have been transformed. Ushering in a new age where data equals capital. Manual processing is giving way to programmed automation. Generic campaigns are being replaced with targeted marketing. Algorithms are usurping spreadsheets. The fabric of payments is evolving.

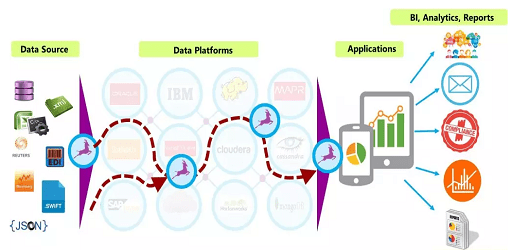

Advanced-Data Processing & Automation

According to McKinsey estimates, banks do not realize the value of more than 80% of the total data collected by them. Therefore, there is a data mine that is waiting to be tapped. AI will help organizations realize the full potential of their data. AI can effortlessly consume large amounts of data, process information faster than human efforts, and provide insightful outputs based on inference. The more data that can be processed, the more refined and accurate the data analysis results.

By allowing AI to extrapolate from data, companies will gain insights into their customers, leading to more customized products, services, communication, and advice. The computation speed can be leveraged to enable a faster feedback loop, which will continually learn and provide updated insights, thus allowing adaptability of product development and marketing strategies.

Organizations will also see increases in productivity as a result of automation and machine learning. Time-consuming work such as compliance reporting, and customer onboarding communications. And administrative documentation can be made more efficient and accurate with AI-powered automation. Artificial Intelligence Vs Machine Learning

Personalized Customer Experience

These technologies will give rise to a more personalized customer experience. One example is the use of chatbots. Chatbots are automated chat systems that are designed to simulate human interaction. Chatbots identify emotion and context within the text and will respond most appropriately based on previous interactions.

Bank of America recently implemented its own chatbot or resident digital financial assistant named ‘Erica,’ which has been widely recognized as a successful initiative. Earlier this year, Bank of America confirmed that Erica assisted with 8 million client requests in a press release earlier this year. Personalized communications will allow organizations to ‘humanize’ what can be quite structured. And cold processes give the consumer the façade of having a human on the other end.

Although AI can lend itself well to customization, it can potentially lead to other unwanted behavior at times. Predatory lending or marketing, where individuals are targeted based on information gathered through machine learning. They are only examples of how organizations or individuals can exploit these technologies. As such, industry policies and standards relating to privacy and prudential behavior must be continually reviewed and updated as the industry continues to adopt AI and machine learning in various degrees. Financial ethics will play a big part in how AI or machine learning will continue to be accepted in the financial services industry.

Talent Transformation

The introduction of artificial intelligence or machine learning does not equate to a bleak future for human professionals. Computers can be tasked with doing repetitive and tedious jobs such as data processing. For example, instead of manually trolling through a copious amount of historical data. A financial advisor can provide customized advice with a click of a button. Employees will subsequently have more capacity to undertake higher-level responsibilities and expand their skill sets.

AI will alleviate some of the monotony of certain jobs and create new focus areas for professional development. Certain types of individuals will embrace this change while others may not. Organizations will need to invest time and money into transforming their talent alongside their technology to accommodate this fundamental change in an employee’s role.

Better Fraud Detection

Machine learning has been fundamental in enhancing fraud detection in the financial services industry. Indue’s Financial Crimes service is a prime example of how talent and technology co-exist to provide a whole that is more efficient than the sum of its parts. The service has embraced the benefits of machine learning with its foundation in the Safer Payments platform. It leverages machine learning algorithms to enhance its fraud detection capabilities continually.

The platform is a neural engine that analyses a large transactional data pool to detect certain patterns and flag any anomalous behaviors. Indue’s financial crimes specialists leverage the cognitive computing provided by the platform. But strengthen the process by performing the executive decision and customer engagement that is critical to fraud management. The platform assists with pattern detection, and data modeling. And predictive capabilities whilst the specialists provide the emotional intelligence that only humans can offer. This reciprocity approach has been fundamental to the success of Indue’s Financial Crimes service.

Would you like to read more about Artificial Intelligence Vs Machine Learning-related articles? If so, we invite you to take a look at our other tech topics before you leave!

![]()